Highlights

- Sign up for Webinar, Thursday October 19th here: TOC Webinar

- Consolidated Area Totals 2,277.7 ha

- District Has Never Been Consolidated for Systematic Gold-Silver Exploration

- Provides Significant Increase to Land Position Available for Development Infrastructure

- Increases Discovery and Resource Potential for a New Pilar Gold -Silver District

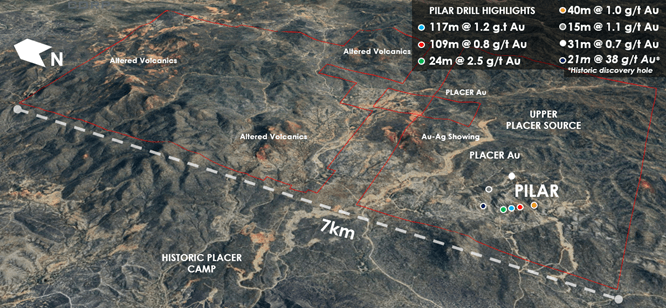

Calgary, Alberta – October 18, 2023 – Tocvan Ventures Corp. (the “Company”) (CSE: TOC; OTCQB: TCVNF; FSE: TV3), is pleased to announce it has completed and signed a Definitive Agreement with a private title owner for the 100% acquisition of 2,172.7 ha immediately adjacent and north of its Pilar Gold-Silver Project in Sonora, Mexico. The area includes highly prospective zones that have seen limited exploration to date, however recent placer mining suggests untested gold and silver potential (see figure 1). Tocvan’s technical personnel have already completed initial field reconnaissance to evaluate new target areas, results are pending.

“To finalize this agreement is a major milestone for the Company, completely changing our trajectory towards becoming a producer with significant resource potential.” Stated Brodie Sutherland, CEO. “To now be able to explore a much larger area primed for new discoveries and provide immediate expansion potential to Pilar itself gives our shareholders added upside. The acquisition also gives us ample space for future mine infrastructure as we continue to advance Pilar towards production. We look forward to quickly evaluating this new area to begin aggressive drill campaigns targeting expansion and discovery.”

Figure 1. Overview of Pilar Expansion Area. Large hydrothermal alteration cells, recent placer mining and similar geology to Pilar all indicate the area is highly prospective for Au-Ag and Cu mineralization. The area has never seen systematic Au-Ag exploration.

Terms of the Agreement

Total cash payments of $4 million USD and 2.5 million common shares will be issued over the 5-year term of the agreement. A total minimum work commitment of $1 million USD is considered over the agreement. The title owner will retain a 2% NSR on the properties acquired. After the initial 5-year term the Company can elect to extend the agreement an additional 10 years by starting advanced royalty payments or purchase full title ownership through an additional cash payment of $500,000 USD.

Table 1. Summary of the Definitive Agreement Terms. All cash values are in USD. Common shares issued are subject to certain sale restrictions over the course of the agreement.

| Agreement Terms | |||

| Milestone Dates | Cash | Work Commitment | Common Shares |

| Closing | 250,000 | NIL | NIL |

| 6th Months after Closing | 200,000 | NIL | 250,000 |

| 1st Anniversary | NIL | 100,000 | 500,000 |

| 2nd Anniversary | 1,050,000 | 150,000 | 500,000 |

| 3rd Anniversary | 1,150,000 | 250,000 | 750,000 |

| 4th Anniversary | 650,000 | 250,000 | 250,000 |

| 5th Anniversary | 700,000 | 250,000 | 250,000 |

| TOTAL | 4,000,000 | 1,000,000 | 2,500,000 |

About the Pilar Property

The Pilar Gold-Silver property has recently returned some of the regions best drill results. Coupled with encouraging gold and silver recovery results from metallurgical test work, Pilar is primed to be a potential near-term producer. Pilar is interpreted as a structurally controlled low-sulphidation epithermal system hosted in andesite rocks. Three primary zones of mineralization have been identified in the north-west part of the property from historic surface work and drilling and are referred to as the Main Zone, North Hill and 4-T. The Main Zone and 4-T trends are open to the southeast and new parallel zones have been recently discovered. Structural features and zones of mineralization within the structures follow an overall NW-SE trend of mineralization. Mineralization extends along a 1.2-km trend, only half of that trend has been drill tested so far. To date, over 23,000 m of drilling has been completed.

- 2022 Phase III Diamond Drilling Highlights include (all lengths are drilled thicknesses):

- 116.9m @ 1.2 g/t Au, including 10.2m @ 12 g/t Au and 23 g/t Ag

- 108.9m @ 0.8 g/t Au, including 9.4m @ 7.6 g/t Au and 5 g/t Ag

- 63.4m @ 0.6 g/t Au and 11 g/t Ag, including 29.9m @ 0.9 g/t Au and 18 g/t Ag

- 2021 Phase II RC Drilling Highlights include (all lengths are drilled thicknesses):

- 39.7m @ 1.0 g/t Au, including 1.5m @ 14.6 g/t Au

- 47.7m @ 0.7 g/t Au including 3m @ 5.6 g/t Au and 22 g/t Ag

- 29m @ 0.7 g/t Au

- 35.1m @ 0.7 g/t Au

- 2020 Phase I RC Drilling Highlights include (all lengths are drilled thicknesses):

- 94.6m @ 1.6 g/t Au, including 9.2m @ 10.8 g/t Au and 38 g/t Ag;

- 41.2m @ 1.1 g/t Au, including 3.1m @ 6.0 g/t Au and 12 g/t Ag ;

- 24.4m @ 2.5 g/t Au and 73 g/t Ag, including 1.5m @ 33.4 g/t Au and 1,090 g/t Ag

- 15,000m of Historic Core & RC drilling. Highlights include:

- 61.0m @ 0.8 g/t Au

- 16.5m @ 53.5 g/t Au and 53 g/t Ag

- 13.0m @ 9.6 g/t Au

- 9.0m @ 10.2 g/t Au and 46 g/t Ag

About Tocvan Ventures Corp.

Tocvan is a well-structured exploration development company. Tocvan was created in order to take advantage of the prolonged downturn in the junior mining exploration sector, by identifying and negotiating interest in opportunities where management feels they can build upon previous success. Tocvan has approximately 39.9 million shares outstanding and is earning 100% into two exciting opportunities in Sonora, Mexico: the Pilar Gold-Silver project and the El Picacho Gold-Silver project. Management feels both projects represent tremendous opportunity to create shareholder value.

Brodie A. Sutherland, P.Geo., CEO for Tocvan Ventures Corp. and a qualified person (“QP“) as defined by Canadian National Instrument 43-101, has reviewed and approved the technical information contained in this release.

Neither the Canadian Securities Exchange nor its regulation services provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward Looking Statements

This news release contains “forward-looking information” which may include, but is not limited to, statements with respect to the activities, events or developments that the Company expects or anticipates will or may occur in the future. Forward-looking information in this news release includes statements regarding the use of proceeds from the Offering. Such forward-looking information is often, but not always, identified by the use of words and phrases such as “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes” or variations (including negative variations) of such words and phrases, or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. Management believes that these assumptions are reasonable. Forward-looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others, risks related to the speculative nature of the Company’s business, the Company’s formative stage of development and the Company’s financial position. Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws.

There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

For more information, please contact:

TOCVAN VENTURES CORP.

Brodie A. Sutherland, CEO

820-1130 West Pender St.

Vancouver, BC V6E 4A4

Telephone: 1 888 772 2452

Email: [email protected]